Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Extras cover, which is also known as general or ancillary cover, provides cover for the routine treatments that Aussies tend to use regularly. It is important to consider whether purchasing extras cover makes sense for you and/or your family, or whether you would prefer to pay out of pocket for routine treatments. This guide outlines what services are covered under extras, what the benefits and limitations are, the types of cover available in Australia and more.

Contents

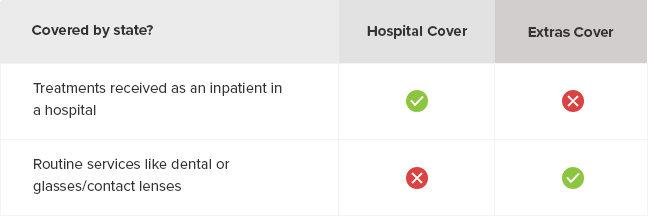

Extras cover is sometimes called general or ancillary cover, and its purpose is to provide cover for the routine healthcare costs that happen out of hospital. Extras cover can be purchased as a standalone policy or to complement a hospital policy, and it’s available in different coverage levels. APRA reported that as of 31 March 2018, 54.6% of the population had extras cover.

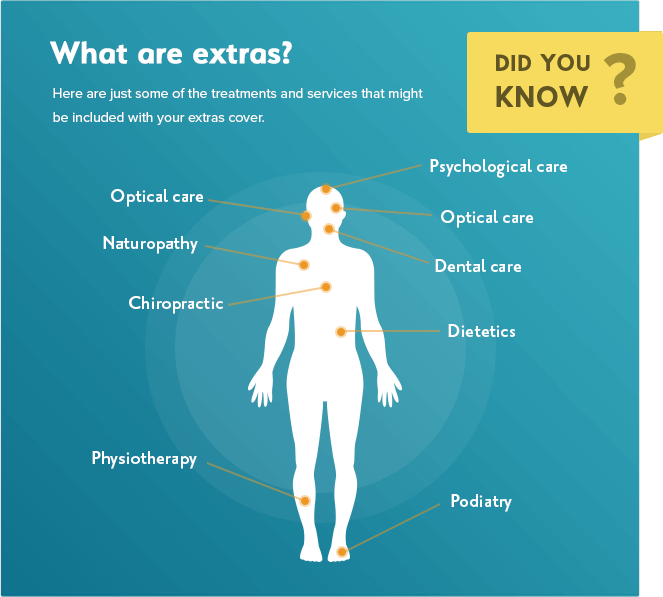

The exact services covered by an extras policy vary between insurers and depend on what level of coverage you opt for. Read the policy details carefully before making a decision to check that you’re covered for the services you use most often.

Common extras include the following:

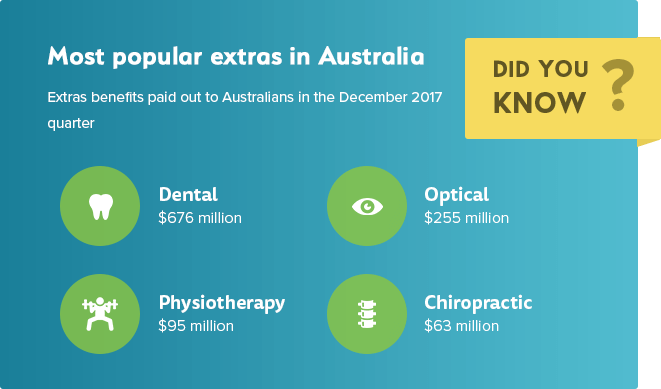

People often think of hospital cover as the insurance they hope they won’t need, while extras cover is in place to subsidise the services they know they’re going to use. For many Australians, most of their regular healthcare spending doesn’t happen in a hospital; it happens at the dentist, the optometrist, the chiropractor, or the naturopath—services that can be covered by extras insurance.

With extras insurance, Aussies can get benefits back on healthcare services they use throughout the year.

Generally speaking, most health funds offer three levels of extras cover. Inclusions, exclusions, and benefit levels will differ between funds, so it’s worth comparing policies from different funds to find one that suits you.

Best for: singles and couples, young and healthy

Basic cover is the lowest level of cover and tends to be the most inexpensive. It may include general dental and optical with a small selection of other extras. Benefit levels are lowest in the basic plans, which means you can claim back a limited amount throughout the year.

You may also find that benefit limits are combined across treatments. This means that you have one benefit amount and it can be reached through any treatments you claim throughout the year.

Best for: Families with young children and middle-aged people

Mid-level extras cover is more comprehensive than basic, including a wider range of services and treatments. Benefit levels are usually higher, and there may be separate limits for different treatments. This gives you a higher level of overall cover.

Best for: Seniors, families with adolescent children, people who use health services frequently

The top level of extras cover is the most expensive, but it offers the most cover. More expensive treatments such as orthodontics or laser eye surgery may be included. Benefit limits are also the most generous, so you can claim back more during the year.

Yes. The Private Health Insurance Rebate is available to people who hold an eligible hospital, extras, or combined policy. The rebate amount you qualify for depends on your income. The rebate can be claimed as a reduction to your health insurance premium or as a tax offset on your tax return.

Depending on your age, family status, and income level, you may be entitled to a Government Rebate on your private health insurance policy. Use the sliders and dropdown menu below to calculate your rebate.

| Singles | < $90,000 | $90,001 - 105,000 | $105,001 - 140,000 | > $140,001 |

|---|---|---|---|---|

| Families | < $180,000 | $180,001 - 210,000 | $210,001 - 280,000 | > $280,001 |

Rebate |

||||

| Base Tier | Tier 1 | Tier 2 | Tier 3 | |

| Age < 65 | 25.059% | 16.706% | 8.352% | 0% |

| Age 65-69 | 29.236% | 20.883% | 12.529% | 0% |

| Age 70+ | 33.413% | 25.059% | 16.706% | 0% |

Yes, there are usually waiting periods associated with extras cover. These are set by the fund and there may be different waiting periods depending on the benefits.

Unlike with hospital cover, there are no portability laws in place to prevent you from re-serving waiting periods on an extras policy with the same level of cover. If you switch to a new fund, you may be required to serve a waiting period that you already served with your previous fund. However, the good news is that most funds will let you off the hook and waive the waiting period.

Extras claims may be subject to various limits. Again, this will vary by fund. If you’re unsure of your limit or how much you have used, it is often easy to check through your online account or your fund’s app, if they have one. Otherwise, you can contact your fund.

Here are some common limits applied to extras benefits:

Yearly limit: The maximum amount you can claim for a service during the year. Unclaimed benefits do not rollover, but reset at the start of your fund’s year. This is usually 1 January or 1 July but varies by fund.

Sub limit: This is a limit on a service that falls under your yearly limit, and is usually per person. For example, you may be limited to $200 of acupuncture services under a larger umbrella limit of $500 total for natural therapies.

Per-Person limit: Each person covered by the policy may be limited to a maximum benefit level each year.

Overall limit: There may be an overall membership limit that governs the per-person limits on your policy. It is not necessarily the sum of each individual limit, so check with the fund for details.

Lifetime limit: Funds often impose individual lifetime limits on certain expensive services, such as orthodontics or laser eye surgery. These limits carry across all funds and don’t disappear even if you switch funds.

Extras cover is designed to reduce out-of-pocket expenses for regular health-related services and treatments. What you’ll pay depends on three main factors:

What your provider charges for the service you received.

Whether or not your provider has an agreement with your fund.

Your level of cover.

Your extras cover may offer a fixed dollar amount back on services, or you may receive a certain percentage of the fee back. Compare policies to find a structure and premium price that meets your needs.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.