Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Are you an avid sports player? Do you consider yourself an athlete? If so, odds are you have at least thought about how you would be covered incase of an injury.

While it is worthwhile for the general population to take time and serious consideration when examining health insurance options, this task can be even more crucial for athletes and sports players.

Due to the active and sometimes aggressive or dangerous nature of sports, athletes are often more prone to injury than the general population. Furthermore, doctors are seeing an increase in children with serious sports injuries as sports become more competitive and professional in younger leagues.

While Australians are eligible for Medicare, and some sports organisations provide some supplemental sports insurance, it is important to understand what is covered and where health coverage liabilities still exist. Because the provided sports insurance may not cover all potential sports risks, those who participate in sports activities may choose to consider health insurance options to ensure that they are truly covered in the event of an accident, sports injury or unforeseen illness.

Of course, the type and frequency of sport is important in considering and comparing health insurance options. It is also important to be mindful of any previous injuries and how your body might be affected down the line with continued sports activity.

Contents

A sport accident is an event where a player suffers an accidental injury while training for or playing a sport. However, in some sports insurance policies, this definition can expand to encompass injurious damage done to property, vehicles and non-players as well.

Imagine, for example, the kind of accident that could happen if too many people were allowed to enter a crowded grandstand. A crush and stampede could ensue, or even something as small as a minor back injury sustained by just one individual.

Injuries can (and do) happen at sports venues, but a sport accident is typically described in most personal insurance policies as an injury you (or the insured) sustains while engaging in a sporting activity.

Sports-related injuries have many causes. An insufficient warm up can render a player’s muscles more vulnerable to sprains and tears, while repetitive motion or poor sports equipment can also play a role in doing damage to the human body.

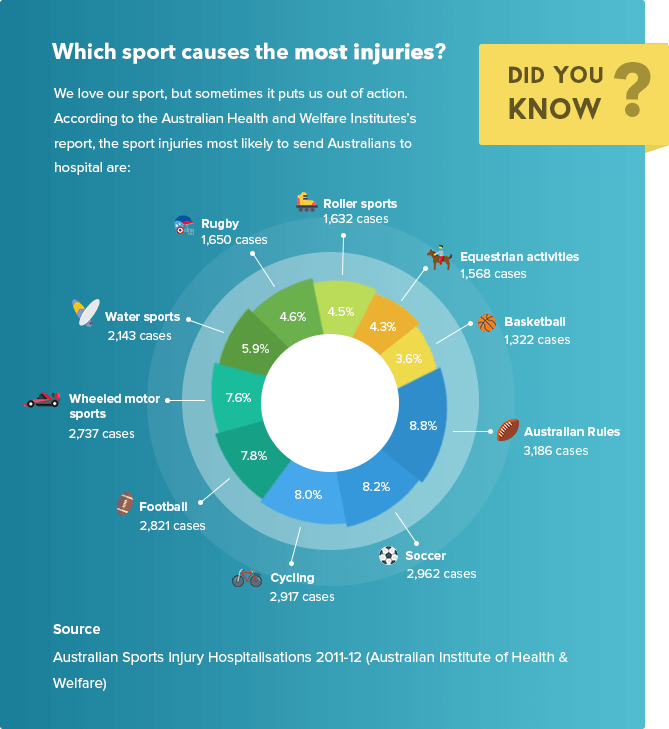

Some of the most common sports in Australia, such as football (Aussie Rules, League and Union included), soccer, basketball, netball, hockey and cricket account for 75% of all sports injuries in Australia.

In particular, Aussie Rules Football sees plenty of injuries. Some of the most frequent are muscle strains (hamstring, groin, ankle, quadricep, calf) and fractures.

But you don’t need to be playing a high-impact sport to be vulnerable to a sports injury. Even walking, running and dancing can put you at risk, particularly when you are exercising at a high speed or pushing yourself to new fitness goals.

There’s no denying that physical activity is good for us, and playing sport is a part of a healthy fit lifestyle. But it’s clear that a sport accident can happen to anyone. That’s why many Australians seek out personal sports insurance policies, as well as life and health cover that caters to their hobbies and lifestyle.

When it comes to sports insurance Australia has a population among the most active sporting participants in the world.

Professional athletes can access certain types of insurance but may struggle with others.

For example, a professional mixed martial arts fighter may struggle to get access to comprehensive life insurance without a related exclusion. However, other insurance companies may be willing to offer some kind of sports cover.

In many team sports, businesses or organisations can help players access the right information and policies regarding what insurance they may need.

Group personal accident insurance provides businesses or organisations policies that typically cover events like accidental death and disablement, loss of salary due to accidental injury and/or sickness and others.

Sports group personal accident insurance generally looks after sporting associations who want cover for their sporting bodies and teams, with one easy-to-manage policy.

Whether you’re looking for plain health cover for accidental injuries or comprehensive sports insurance, Health Insurance Comparison is an industry leader in comparing health insurance policies from a wide range of insurers.

While Medicare alone may be adequate for some Australians, those who are active with sports may find that they face out-of-pocket costs when using Medicare alone.

Athletes must consider their individual circumstances and sporting activity to determine if Medicare alone will suffice. Specifically, sports participants should take the following into account:

Those who travel as part of their sports activities might run into unexpected difficulties when outside of their normal service area. While Medicare will cover all participants while they travel through Australia, athletes might notice a difference in availability and wait times depending on their location.

Medicare-only coverage will certainly cause a substantial gap payment for those athletes who travel overseas as Medicare does not cover medical expenses incurred outside of the country.

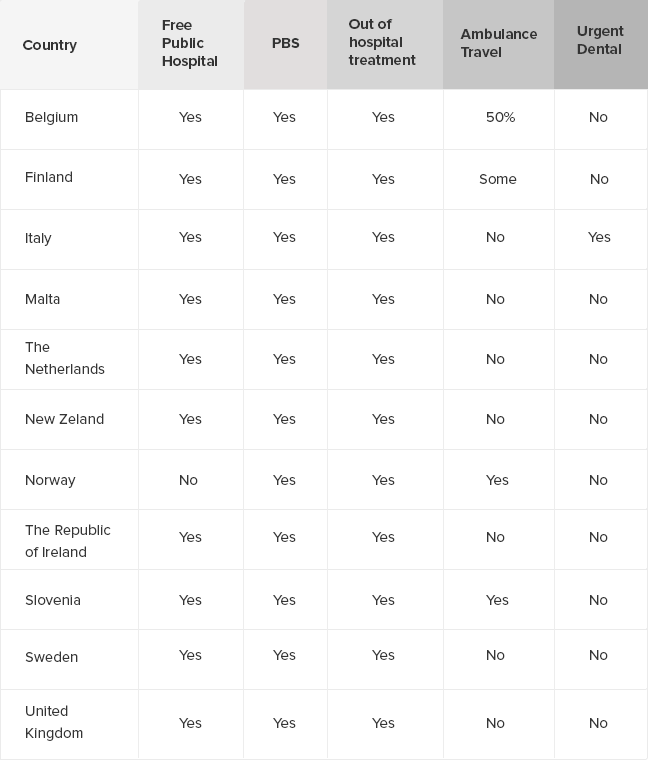

While Medicare-only recipients might be eligible for state-sponsored healthcare under a Reciprocal Health Care Agreement, these agreements do not cover the totality of healthcare expenses and are only available in a handful of partnering countries.

Countries that participate in Reciprocal Health Care Agreements with Australia and may cover some medical expenses include:

Countries outside of this list are not included in the agreement and will not cover any medical expenses under a state sponsored program – even for traveling athletes.

When travelling outside of Australia, athletes, tourists, and other business travels should consider an insurance supplement.

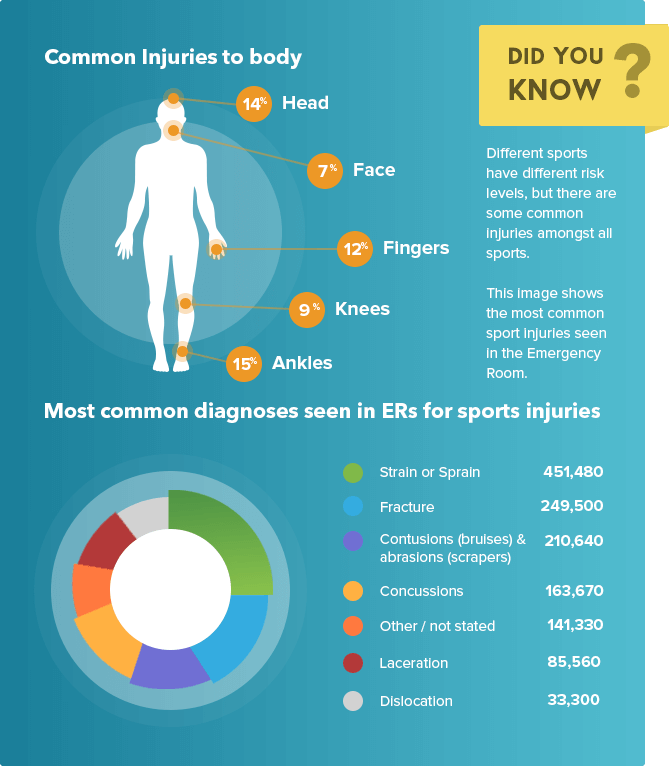

Responsible athletes looking to ensure they have adequate health insurance should always consider injuries that are commonplace or more likely in their sport.

For example: Knee traumas, such as cartilage tears and anterior cruciate ligament (ACL) sprains are some of the most common injuries in soccer. Unfortunately, these types of injuries often require surgery.

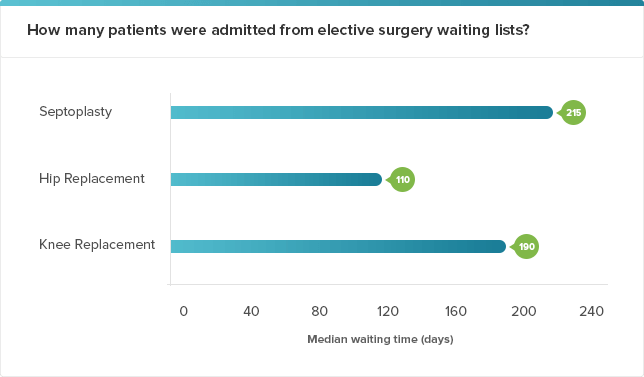

Because these injuries are generally not life threatening, it is likely that Medicare will consider them as elective surgeries. In the most extreme cases, patients awaiting elective surgeries through Medicare can see wait times of over a year.

For those needing orthopaedic surgery, like many athletes with knee injuries, wait times average around 70 days – or over two months.

There are several other common sports injuries that may require specialist services such as:

With that said, if an athlete knows that he or she is more likely to be at risk for a specific injury, he or she should make sure that they have adequate coverage for the related treatment.

Sports insurance sounds like it would be the obvious option for all athletes and avid sports players, but what is it?

Personal Accident Insurance is sometimes referred to as Sports Insurance when marketed specifically for athletes. This type of insurance acts as a filler to some items and services not covered by Medicare at all. Note that it does not provide coverage for gaps with items that may be partially covered under Medicare.

Sports insurance may also cover an individual who sustains injuries that prevent him or her from working. These policies can cover up to 75% of lost income and could be a good option for those who play sports and also work in physical environments. For example, athletes who also work in the construction industry.

Sports insurance may assist in covering lost income due to a sport injury, and may also help supplement other costs for services not covered by Medicare.

Private health insurance can provide the most flexibility for athletes as they can often tailor their coverage to meet specific sporting needs. After evaluating which injuries are most likely to occur, and how travel could affect medical needs, athletes can select fully comprehensive or more limited private health insurance plans to suit their needs.

With adequate private health insurance coverage, patients can save an estimated 85% on their out of pocket expenses when encountering a sports injury.

Choosing the right type of healthcare coverage for your needs is important. You should consider being covered for routine check-ups as well as potential emergencies.

After considering your athletic needs and weighing them against your general healthcare needs, you can choose the type of coverage that is right for you. Fortunately, there are a wide variety of coverage options available. You can opt for minimal coverage that only covers specific items, or you can select more comprehensive care that leaves you with fuller coverage and fewer out-of-pocket expenses.

No matter your decision, make sure that your health insurance choices reflect your priorities. Make a list of those priorities and base your more in-depth comparisons on those needs.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.