Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Imagine the terror that comes with an emergency, from calling 000 to seeing your loved one packed away in an ambulance. Now imagine the added stress that could come with getting a whopping big bill for the service.

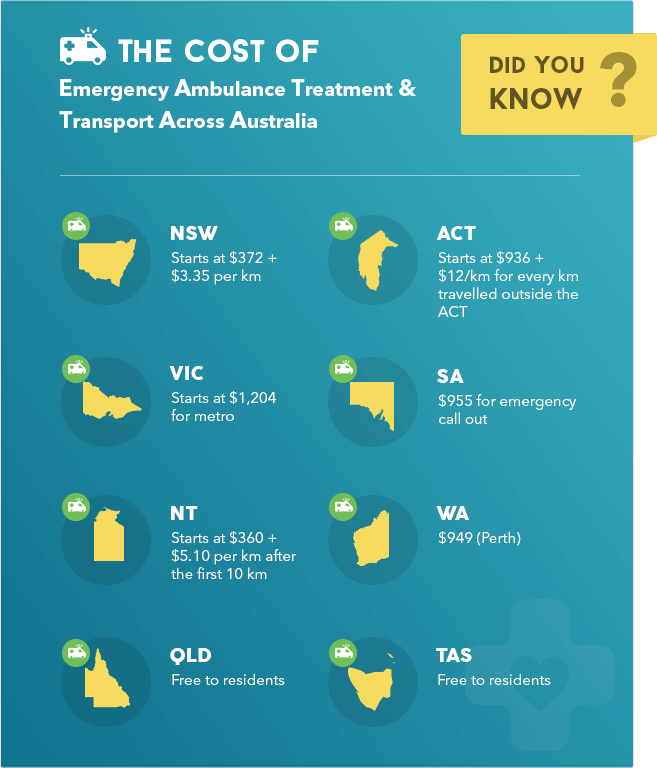

The fees for ambulance services across Australia varies by state and territory, and the costs can be significant. Luckily, there is a specific kind of cover that can give you peace of mind and save you money if you or someone in your family needs it.

Contents

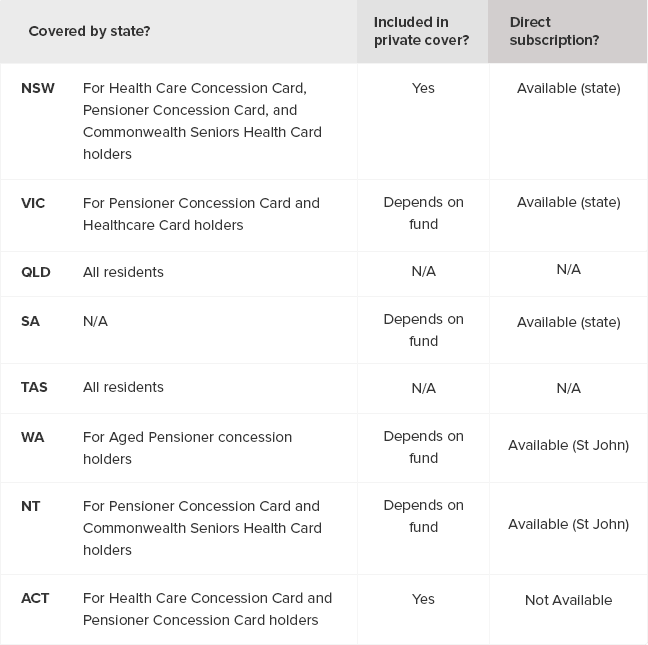

Not every Australian needs cover; it depends on where you live. Each state and territory in Australia has its own set of rules that decide if there’s a fee for ambulance services, and how much that is. Find your state or territory below for more information.

Queensland

If you’re a Queensland resident, you’re in luck, because your tax dollars have you covered for emergency prehospital ambulance treatment and transport all over Australia. If you or a dependent receives service in another state, simply send the invoice to the Queensland Ambulance Service along with proof of your Queensland residency.

Tasmania

Residents of Australia’s island state can also breathe easy, because the state is currently willing to pick up the tab for your ambulance services. Tasmania has reciprocal arrangements in place for all states and territories except South Australia and Queensland. These reciprocal arrangements only apply to emergency road services. Tasmanian residents visiting South Australia and Queensland will be responsible for any services incurred in those states.

New South Wales

Pensioners and concession card holders in NSW are exempt from ambulance fees. Everyone else is billed for 51% of the fee; the rest is subsidised by the NSW government. Fees are made up of a call out charge plus a per-kilometre charge for the round trip from the ambulance station, including any stops in between. Members of an eligible hospital cover are automatically covered by their health insurance for emergency transport.

Australian Capital Territory

In general, ACT residents are responsible for paying their own way when it comes to ambulance cover. There is a base fee plus a per-kilometre charge for emergency callouts and booked non-emergency services. However, the following people are exempt from paying for services in the ACT:

Victoria

Victorians with a valid Pensioner Concession or Health Care Card can receive free clinically necessary transport. However, this doesn’t always apply when transport is from a private facility. Otherwise, cover is available through an Ambulance Victoria membership or some private health funds.

South Australia

South Australians need to get covered through SA Ambulance Service or a private health fund. Anyone who isn’t covered will be liable to pay the invoice for services.

Northern Territory

Ambulance services in the NT are provided by St John Ambulance, and fees are charged based on a call out fee plus a per-kilometre fee. NT residents can avoid the fees by becoming a member of St John or by taking out private health insurance that includes coverage.

Western Australia

WA’s ambulance services are also provided by St John Ambulance. Certain concession card holders in WA are eligible for full coverage of standard transport fees, while other concession card holders receive a 50% concession. For everyone else, a fee will be incurred unless you have private cover or take out a policy with St John’s.

You have two options when it comes to buying cover, and one isn’t necessarily better than the other. The type you choose is up to you, and depends on where you live and the type of private health cover you prefer.

Hospital Cover

The main purpose of hospital cover is to cover the cost of hospital stays and associated medical procedures and services. However, emergency cover is sometimes offered as part of hospital cover. This can be a convenient option if you’ve already got private health insurance (or if you’re looking to get it), plus you’ll still be eligible for the federal government’s health insurance rebate.

For more information on the rebate, click here.

Ambulance-Only Cover

If you rely on Medicare and don’t have private health insurance, you may be able to buy ambulance-only cover. Some states and territories offer cover directly through the state ambulance service. Otherwise, it may be available as a standalone policy through a private health insurer.

Not all ambulance policies are created equal. It pays to read the fine print so you know exactly what you’re covered for. Here are five factors to consider when you’re shopping around.

Ambulance responses are generally classified as emergency or non-emergency services, and they may not be covered equally under insurance. Some funds may actually charge a co-payment for non-emergency services.

Check whether your cover extends to the following circumstances:

It’s unlikely that your policy will cover every type of transport. Many policies won’t let you claim for transport between health-care facilities. You can also expect a cap on the number of times you can be transported each year.

Most private policies come with a seven-day waiting period before you can claim. Ask your insurer about waiting periods when you sign up so you know what to expect.

If you need an ambulance when you’re traveling interstate, find out whether your policy will cover the cost. It usually depends on reciprocal agreements between where you’re a resident and where you are when you need it. The type of transport (emergency or non-emergency) can also be a factor.

Air ambulances are common across Australia, particularly in remote areas. As you might expect, emergency helicopter or fixed-wing transportation is not exactly pocket change. For example, the cost of air transport in Victoria can go as high as $25,559—and that doesn’t include the road transport.

It’s impossible to know whether or not you’ll ever need it, but the fact remains that it can be very expensive without insurance. Having cover can provide assistance in paying for services, leaving you to focus on the people you love, not the bill.

There are three types of health insurance in Australia. They are:

Hospital cover can ensure any unexpected surgeries, treatments or hospital stays you may require will be covered. With appropriate cover you will have the flexibility to choose your own doctor and the option of receiving treatment in a private hospital. Most hospital covers allow you to stay in a private room. One other perk is skipping the public hospital system’s waiting list, which can be lengthy for non emergency treatment.

Extras cover pays benefits for a range of services, often including treatments and procedures related to the following:

Ambulance cover, as the name suggests, will cover you should you require emergency ambulance transport. In an emergency, there is enough to worry about. Having the expenses covered provides security and peace of mind. Many hospital covers include emergency transport. If yours doesn’t, you will need to shop for this separately.

Life is unpredictable. You never know when you might need cover. No matter what life stage you’re in, there’s a policy out there for everyone. You can select as much or as little cover as you want, depending on your health needs and requirements. It’s a small price to pay for the peace of mind health cover provides.

There is no one answer here. Costs vary across providers and policy types. Just because a policy is cheap, that does not mean it is ‘value for money’ and vise versa. Make sure you check what’s included and excluded in a policy before signing up, as you want to purchase a policy that best fits your specific needs.

There is no denying emergency services are crucial. When your sickness or injury strikes unexpectedly, the need for an ambulance is unquestionable.

The main benefit is cutting the costs associated with emergency services. Some call out fees can cost more than $1,700. Having the right cover in place provides peace of mind, as you know you’ll be covered no matter what life throws at you.

Ambulance cover varies between insurers. The best way to find out what is and isn’t included is by directly checking with the insurer what levels of cover they offer.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.