Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Contents

So you’re ready to shop for a private health fund! You’ve probably got an idea of what you’re looking for. Price and level of cover are two of the most important factors for many people when shopping for health cover.

But there are some other factors to consider, like the fund’s reputation, member networks, and perks. Australia has a long list of health funds and they’re all competing for your business, so each one offers a different combination of pros and cons.

Remember, you can always do a price and policy comparison of some of Australia’s leading funds right here on Health Insurance Comparison. In this guide, we’ll look at some fund-specific factors so you have a real-world example of what to expect when you shop around.

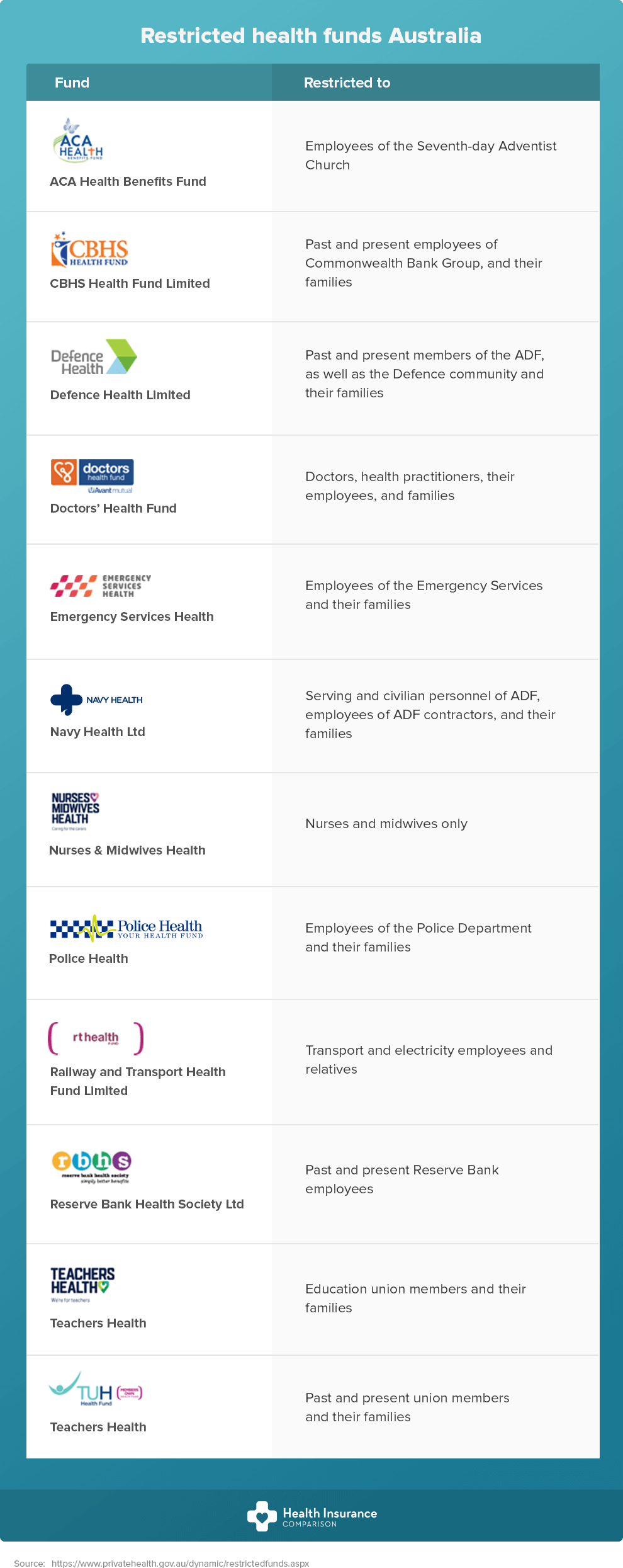

Let’s start with an overview on which funds you can join. Not all funds are open to the public; some restrict membership to those who belong to a certain group or industry.

However, these funds often extend membership to family members of a person who is eligible to join. Depending on your family members’ eligibility, you may be able to access a restricted fund.

For example, there are industry-specific funds for the Police Department, teachers, and the Australian Defence Force.

If you’re eligible to join a restricted fund, it’s worth considering it. These funds can sometimes offer lower premiums, more flexible benefits, and cover that is tailored to people in the group or industry.

This isn’t always the case, so it’s still vital to compare funds to be sure you’ve got the deal you want. Think of access to a restricted fund as an option that not everyone has – you’re not obligated to join, but it might meet your needs. Less than 5% of people with health insurance choose a restricted fund, even though many more are eligible.

Next, let’s look at the level of cover offered by various funds. You know that the level of cover you select is important, but that doesn’t make it easier to choose!

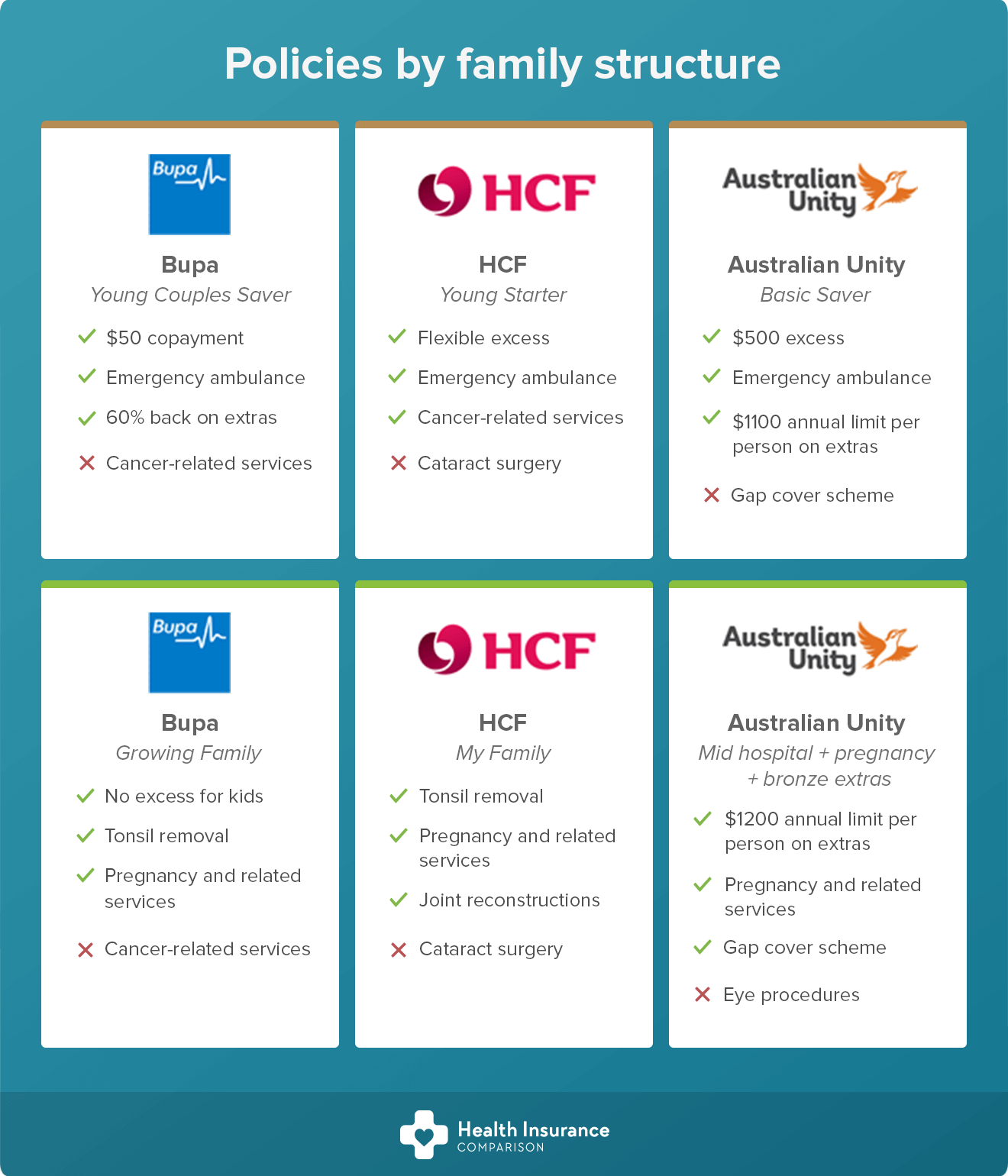

Most funds try to make it easy on you by separating their policies by family structure. Common categories are health insurance for singles, couples, and families. You may also see policies geared towards young couples or singles, growing families, and single-parent families.

Here’s a sample of family-structured policies from three major insurers.

Choosing a fund based on their policy groupings isn’t always as straightforward as it seems. You can see that HCF’s package for young couples includes cancer-related services, while Bupa’s does not.

That’s part of the motivation behind the government’s recent private health insurance reforms. From 1 April 2019, all health funds have to group their hospital cover products into tiers: Gold, Silver, Bronze and Basic.

This should help eliminate some of the confusion around fund policies, allowing you to compare apples with apples. Most funds do offer similar levels of coverage across their product range, though they call them by different names.

When choosing a private health fund, consider whether or not the fund has a member network.

These are networks of hospital and extras providers that have negotiated with the fund to offer special benefits to members. This can be a real bonus if your preferred provider is a member of the network, but it can be detrimental if they are not.

Then you’re faced with the choice: stay with your provider and miss out on some benefits, or change providers to save money?

Providers do leave and join member networks over time, and the benefits and discounts can change, too. You can always ask your preferred provider if they are part of any member network or if they’d consider joining one.

Here’s a look at some existing member networks to give you an idea of what kinds of benefits are on offer.

Bupa’s network is made up of three components: Members First Platinum Dentists, Members First Providers, and Recognised Providers.

With Members First Platinum Dentists, you’ll pay nothing for your regular dental check-up. At Members First providers, you get more back on extras like optical, physio, and chiro. If you visit a Recognised Provider, Bupa will pay a basic set amount towards the cost of covered extras.

Other eligibility requirements do apply, such as waiting periods, annual limits, and policy types.

HBF is focused on serving customers in Western Australia, so it makes sense that most of their Member Plus hospitals are located in WA. They claim to have more Member Plus hospitals in WA than any other health fund.

At these hospitals, you’ll be covered for accommodation and theatre fees, minus a co-payment or excess as directed by your policy.

Medibank offers Members’ Choice hospitals and extras providers. They claim that their extras network covers more types of services than any other private health insurer, which may give you an extra incentive.

Benefits of the Medibank network include capped prices, discounts on optical, free annual dental check-up and clean, and 55% to 100% back on extras, depending on your cover.

First Choice providers give discounted rates to nib members on dental treatments and optical products. All in-network providers offer guaranteed on-the-spot claiming.

Nib reports that their network is growing each month, and includes dentists, optometrists, physiotherapists, and chiropractors. They also have agreements with most private hospitals in Australia.

If you’re looking for a reason to choose one fund over another similar fund, you might want to look at a fund’s performance. Let’s consider complaints.

If you’re not happy with your health fund, you’re entitled to file a complaint with the ombudsman. These complaints are recorded and available to the public.

Health funds are always looking for ways to provide a point of difference to consumers. It can be hard to make yourself stand out in an oversaturated market, so funds often add extra perks for members.

These can come in the form of rewards and loyalty benefits for fund members or sign-on incentives for new members.

When health fund members are healthier, everybody wins. That’s why funds offer discounts and rewards on health services. Funds often go a step further by offering lifestyle discounts as well. Here are a few rewards on the market from different funds.

Offers are subject to change and eligibility criteria apply.

This is a wellness program where you can earn points for completing health tasks, like taking a health assessment or having a regular health screening. Points can be redeemed for:

Member offers include:

Offers for members include:

HBF health members get access to benefits including:

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.