Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Most funds have waiting periods to start off with, and some may be longer than others. However, the government has enforced legal limits for all hospital cover policies to ensure you won’t be waiting forever.

Taking out general (or ‘extras’ cover) is a different story. There are no legal limits to these so each fund will vary.

It’s important to shop carefully to find a health insurance policy that offers minimal waiting times, not only if you require prompt treatment, but also for peace of mind. You want to feel secure from the moment you purchase your policy.

Use our calculator below to find out what your waiting periods might look like should you wish to upgrade or purchase a new policy.

Contents

You will have to serve a waiting period when you start a new private health insurance policy or increase your level of cover. A waiting period protects members of the fund by ensuring that individuals aren't able to make a large claim shortly after joining and then cancelling their membership. This kind of behaviour would result in increased premiums for all members.

Use this calculator to choose a hypothetical date in the future (or leave it on the default setting, which is today's date) to determine when you will be covered for various types of coverage.

| Months | Standard Waiting Period |

|---|---|

| 0 |

|

| 2 |

|

| 6 |

|

| 12 |

|

After taking out a private health insurance policy, there is a set amount of time known as a waiting period, where you’ll be unable to make any claims. It is not only applied when you take out a new policy but also if you decide to increase your level of cover on a current policy.

When this set amount of time is up, your policy will kick in and allow you to make claims and receive the full benefits of your insurance.

The government sets maximum waiting times for all private health funds when it comes to hospital cover only. How long you wait on general cover (also known as ancillary or extras cover) is set by each individual fund, and is not influenced by the government in any way.

Here’s a quick look at the current maximum waiting times for hospital treatment:

They may seem like a nuisance, but they are necessary. Here’s why:

You may be able to avoid some with General (extras) Insurance cover depending on the health insurer you go with. Some funds will advertise no waiting periods. However, even if the waiting time is waived, this doesn’t mean you’ll be free of all restrictions. For example, you may find that coverage is readily available for routine optical or dental care, but if you require further treatment, you may not be covered until the waiting period is over.

Check with the fund that you are considering purchasing from to see whether there are any fineprint details you should be aware of.

So, you’re thinking of upgrading your private health insurance to a higher level of hospital coverage or a new extras policy. Have you checked the following:

Waiting periods are compulsory lengths of time. You must honour these before claiming health insurance benefits. They do not apply if you have already served them or are downgrading your policy.

Standard waiting times for vary depending on the procedure and your chosen health fund. It also depends on the type of cover involved, for example extras cover or hospital cover.

You might be in need of a dental check-up. You should expect to have to wait an average of around 2 months from when you join to when your extras cover actually begins. If you’re in need of dental surgery, then you should expect to have to wait a lot longer before being able to make a claim.

With extras cover, health insurers call the shots when it comes to waiting times. The best advice would be to do your research carefully so you’re prepared and know what to expect.

It depends on your specific fund. Generally speaking, waiting times for extras can vary from 2 to 12 months. Everything is going to depend on the complexity and cost of the treatment involved.

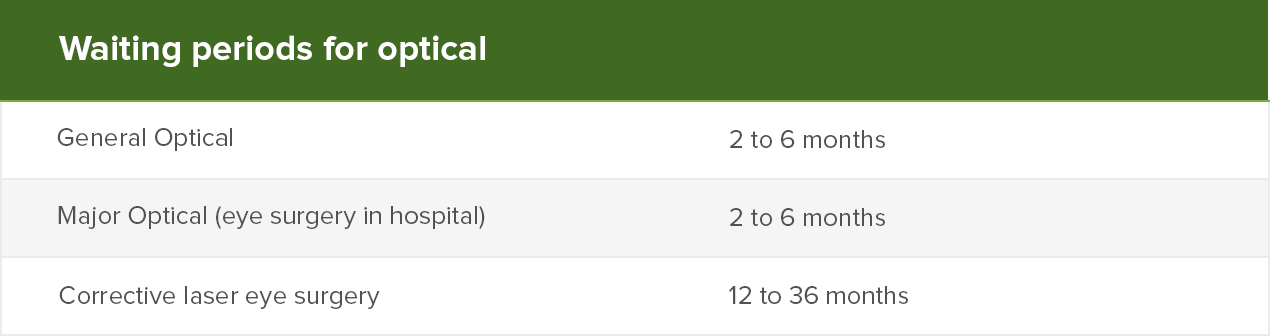

Typical waiting periods for extras include 2 months for dental checkups and physiotherapy. They can be 6 months for glasses and contact lenses and 12 months for big dental procedures such as orthodontics.

There are some conditions under which funds may offer reduced or no waiting period health insurance. This would normally be for a particular promotion to attract new members.

It could be that there’s a particular element of your policy that you know you’ll want to claim on frequently. You should check out the waiting times before you join up. This way you’ll be sure the policy is going to suit your needs.

Some insurers will have special offers. When these are on, they may waive some extras to cover waiting times on combined hospital policies. They do this to tempt new customers to join up. Even so, it is unusual for insurers to waive 12 month waiting periods.

With some special deals, it could be that your insurer won’t expect you to serve waiting times for preventative or general treatments. This might include things like a routine check-up at the dentist. You would still need to wait before claiming for major dental treatment, such as root canals.

The government always determines the maximum waiting periods for all types of hospital cover.

When you’ve got a pre-existing condition you should still be able to claim for treatment as long as you serve the 12 month waiting time. Some examples of pre-existing conditions are high blood pressure and heart disease. They could also include cancer, and diabetes. Other conditions would be those that have been showing signs or symptoms during the previous six months.

Pregnancy and obstetrics cover also have a waiting period of 12 months. Psychiatric treatment, rehabilitation and palliative care have a 2 month waiting time.

You will not have to re-serve waiting times if you switch funds, provided you are taking out coverage of the same level, or of a lower level. On the other hand, if you wish to upgrade your policy, you will have to wait for new, higher benefits to kick in. Your fund will be able to provide you with further information on how long this wait will be.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.