Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Contents

A not-for-profit health insurance provider is one that invests its profits back into its members rather than shareholders. A for-profit health fund pays the shareholders with their surplus, while a not-for-profit health fund uses that money to better serve their policyholders.

The result of being part of a nonprofit health fund is typically lower premiums and additional coverage. However, this isn’t always the case. It’s worth shopping around to find the best deal on health insurance for your individual needs. Or save time by using our free tool to compare health insurance policies.

For-profit health funds have benefits of their own, which keeps them competitive with not for profit health insurance providers.

Before we go into the different nonprofit funds in Australia, let’s go over what it means to be a nonprofit health fund.

These funds—also called not-for-profit, or nonprofit—reinvest their surplus back into the fund, rather than shareholders. That’s the main difference between nonprofit and for-profit funds: what they do with the surplus.

As indicated by the name, for-profit funds are run to make a profit. In contrast, a nonprofit puts the money it collects for premiums towards operating costs and member benefits.

Anything left after operating costs is retained by the fund to ultimately benefit members, usually in the form of better services, more products, or lower premiums.

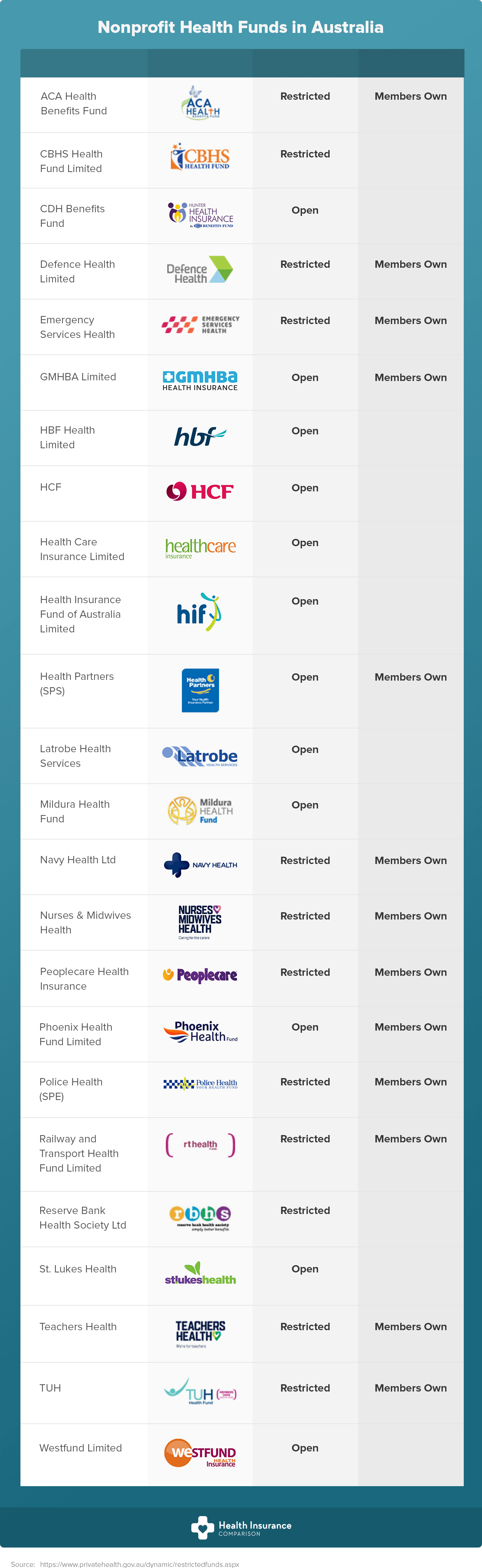

Yes, there is a long list of nonprofit health funds in Australia; 26 to be exact. There are both restricted and unrestricted nonprofit health funds in Australia.

Restricted health funds are only available to those who are in a particular industry or group. Open health funds are open to the public.

Here’s a list of the nonprofit health funds currently operating in Australia.

Many of Australia’s nonprofit health funds are part of Members Own, a group of not-for-profit and mutual health funds. The organisation was established in 2014 as an alternative to major for-profit health funds. There are 16 health funds (19 brands) under the Members Own umbrella.

Members Own promotes not-for-profit health funds under the philosophy that for-profit funds are less effective at delivering value health cover. We’ll explore this concept in more detail later in this guide.

Mutual companies are those owned by members, not shareholders. Although these health funds may technically be listed as for-profit, they often operate in a way that’s similar to nonprofit funds.

Mutual companies are owned by members, who are usually also its customers. Profits go back into the company, not out to shareholders or external owners. Since the customers double as members, they are the recipients of these benefits.

Australian Unity is an example of a mutual health fund in Australia. It is part of the Members Own network, but it is considered to be for-profit.

When comparing nonprofit health funds, you might see the terms ‘open’ and ‘restricted’. Open health funds are open to anyone, while you must be a member of a certain group or industry to join a restricted health fund.

Examples of restricted funds include Defence Health Limited, Police Health, and Teachers Health.

These funds may offer products that are customised to suit members of a specific group or industry, which can make them attractive options.

Restricted health funds are often nonprofit, and eligibility requirements often extend to include family members. Check out our guide on restricted funds to learn more.

Out of the 38 health funds operating in Australia, privatehealth.gov.au lists 24 as nonprofit.

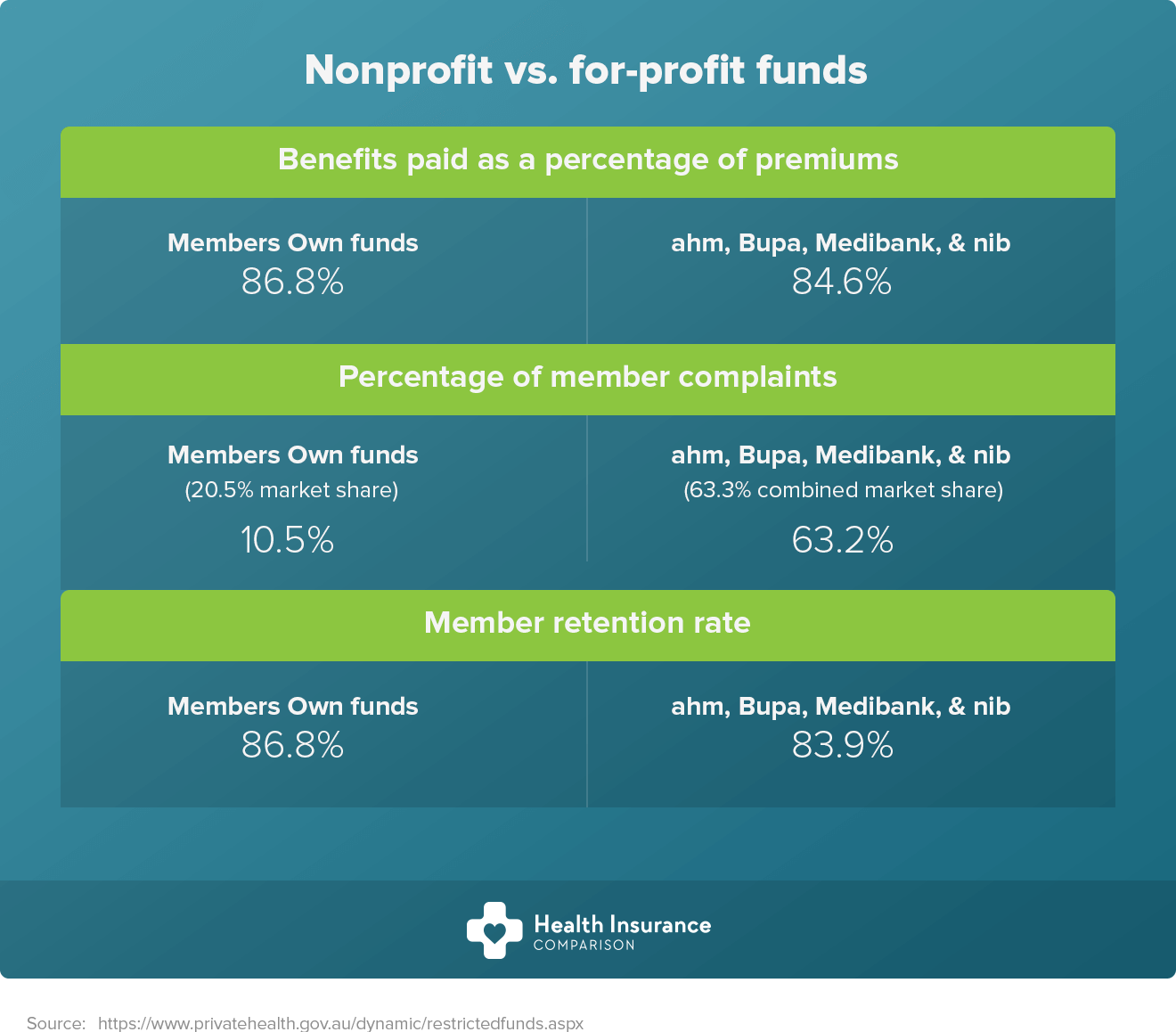

At first glance, nonprofit health funds appear to offer more advantages to members than for-profit funds. Members Own claims that not-for-profit funds give more back to members, have higher member satisfaction, and better retention.

Here’s how those numbers break down, according to data from Members Own.

While these numbers are compelling, they don’t necessarily tell the whole story. With the exception of member complaints, the differences between the two types of funds are actually a small margin.

When deciding between a nonprofit and for-profit health fund, there are some other factors to keep in mind.

Price is always a consideration when comparing health cover, but remember that it’s not the only thing you should look at. The cheapest policy is not necessarily the best!

Nonprofit health funds may be able to offer lower premiums, but it doesn’t mean that they always do. Shop around to get a clear picture on market price for the type of coverage you want.

That brings us to our next point: coverage. There are so many health insurance products on the market, you should be able to find a level of cover that suits your needs. That cover may or may not be available through a nonprofit health fund.

Nonprofit funds are continually improving their product offerings, but the same can be said for for-profit funds. Competition is strong among health insurers. Australians are more discerning than ever about where they’re putting their money, and if an insurer doesn’t offer a good product, consumers are likely to move on to someone who does.

In fact, competition has driven many insurers to offer incentives, such as rewards programs or vouchers. These tend to be offered by for-profit funds, as not-for-profits may not have the resources to do this.

However, a free gift does not equal a great policy, so while these little bonuses may be appealing, think of them as an added extra—not a reason to join a fund.

Here are five things to look at when comparing policies:

So, are nonprofit funds better than for-profit funds? They can be, but not always. It depends on what you’re looking for and which funds you have access to.

Your best bet is to compare policies before you make a purchase. Consider both nonprofit and for-profit funds, and don’t shy away from asking questions as you shop.

Our team of Melbourne-based product experts are here to help. They can answer your questions, explain the difference between policies, and will do their best to save you money. Get your free quote today to get started!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.